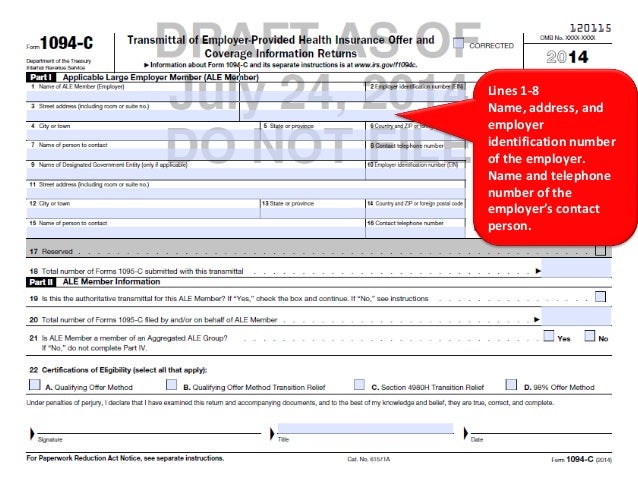

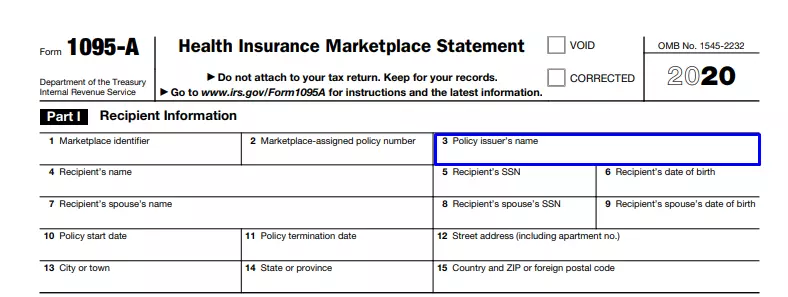

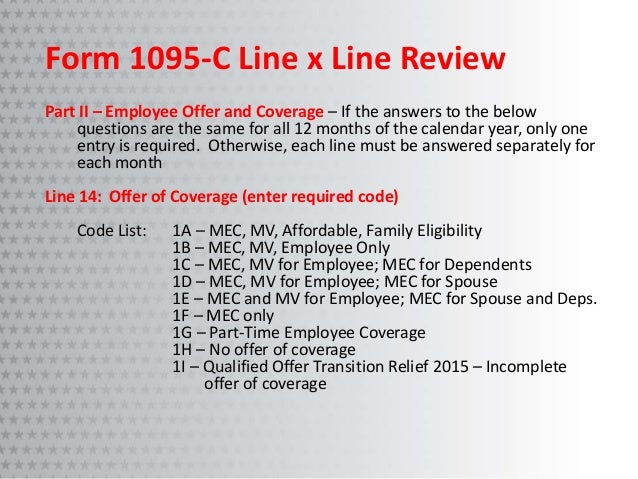

· Whats a Market Identifier ? · Each Marketplace health plan has a unique 14character identifier that's a combination of numbers and/or letters You can find a plan's ID below the plan name when you preview plans and prices If you've already enrolled in a plan, you'll find your plan's ID in your Marketplace account under "My Plans and Programs"Applicable Large Employers (ALEs), or employers with 50 or more fulltime equivalent employees, are required to send Form 1095Cs to all fulltime employees (those who work an average of 30 or more hours per week) as well as any employee who was enrolled in their health insurance plan

Didn T Get A 1095 A Or Ecn You Can File Taxes Without Them

Marketplace identifier 1095-a blue cross blue shield

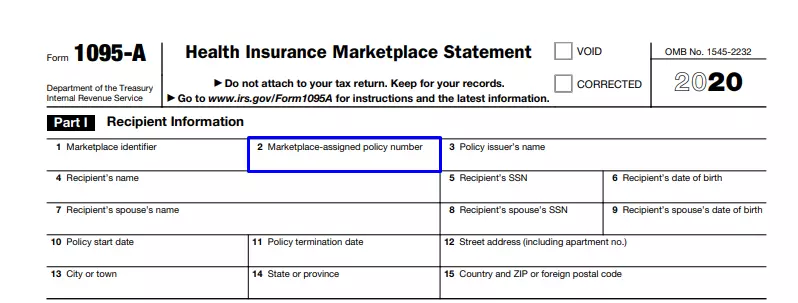

Marketplace identifier 1095-a blue cross blue shield-And the marketplace assigned policy number??? · 1095C Forms According to Forbes, the forms 1095A and 1095B are new for the 15 tax season These two forms come from employers;

How To Get Form 1095 A Health Insurance Marketplace Statement Picshealth

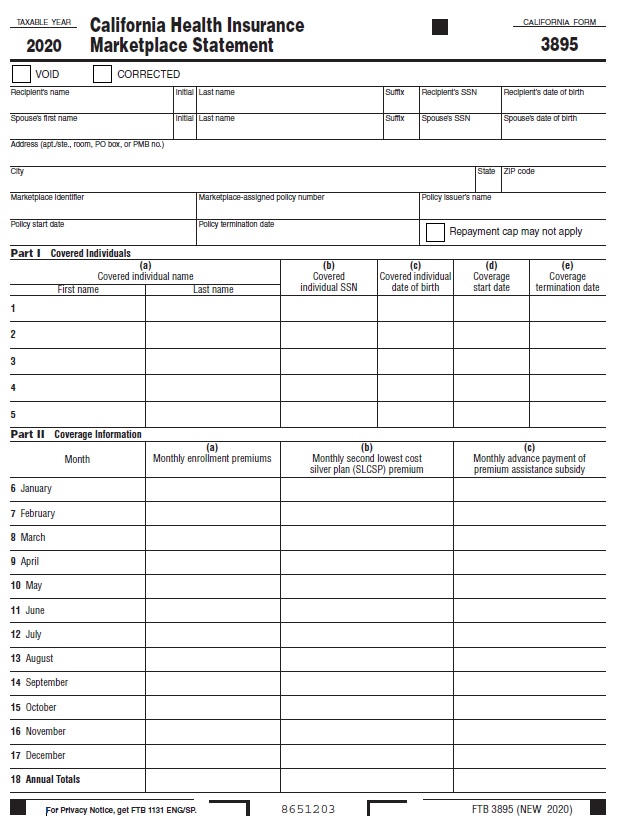

ISO 103 Market identifier codes You can consult the most frequently asked questions (FAQ) here Should you have questions related to the market itsef, for example which instruments are traded, is it a regulated or a nonregulated market, etc please contact the market5498 Forms Form 5498 Form 5498HSA Form 5498ESA;Form 1095C Code Series 1 and 2 For ACA 15 reporting going forward Code § 6056 and Code § 6055 have added two employerreporting requirements to the Internal Revenue Code (Code) Code § 6056 requires applicable large employers (ALEs) to provide an annualized statement at

Tax Extension Forms Form 68 Form 4868 Form 7004 Form 09; · Updated on March 3, 15 in this alert Marketplace Form 1095A may be reissued due to incorrect information February 10, 15 On Jan 12, 15, the Centers for Medicare and Medicaid Services (CMS) issued a series of FAQs related to IRS Form 1095AThe Form 1095A will be sent to individuals enrolled in 14 health coverage on the Health Insurance MarketplaceSearch for ticker symbols for Stocks, Mutual Funds, ETFs, Indices and Futures on Yahoo!

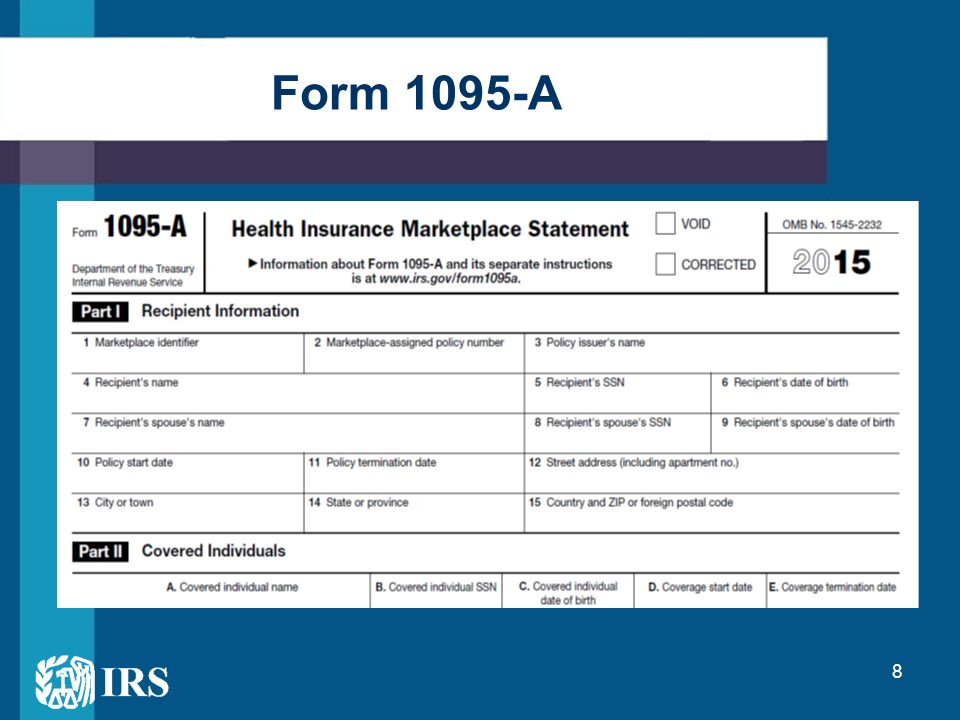

· A 1095C for health insurance provided by an Applicable Large Employer group plan will come from the company If you bought health insurance through the Health Insurance Marketplace, you should have received a Form 1095A, Health Insurance Marketplace Statement, by early February · Form 1095C –Individuals who enroll in health insurance through their employers will receive this form If you got any of the forms identified above, do not throw them away The 1095 Forms serve as proof of qualifying health coverage during the tax year reportedThe most uncluttered, userfriendly property portal Find hundreds of 1000s of properties for sale & to rent from leading UK estate agents OnTheMarket

Taxes What To Do With Form 1095 A Health Insurance Marketplace Statement Healthcare Gov

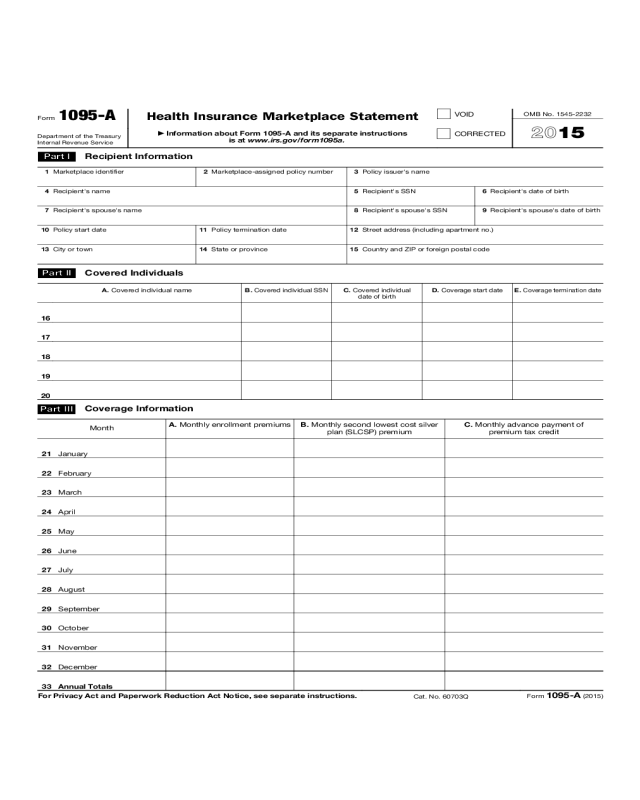

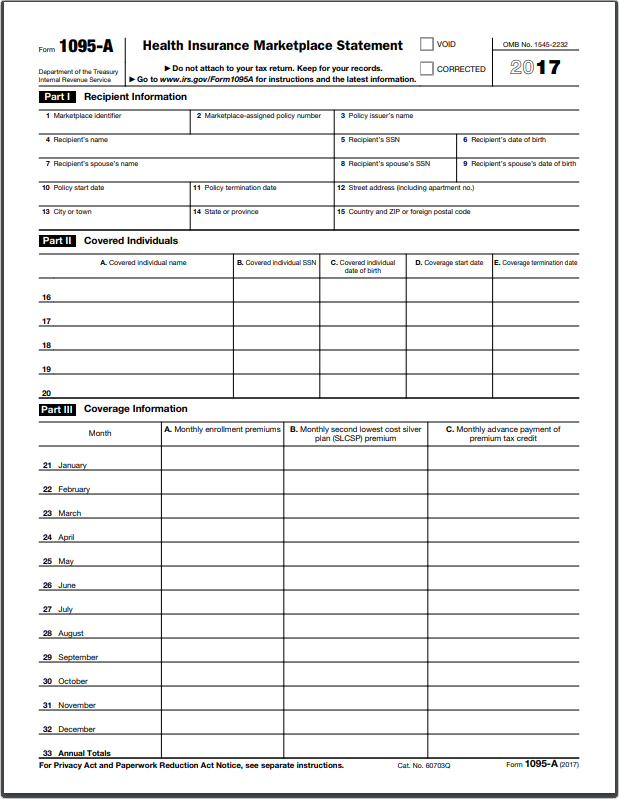

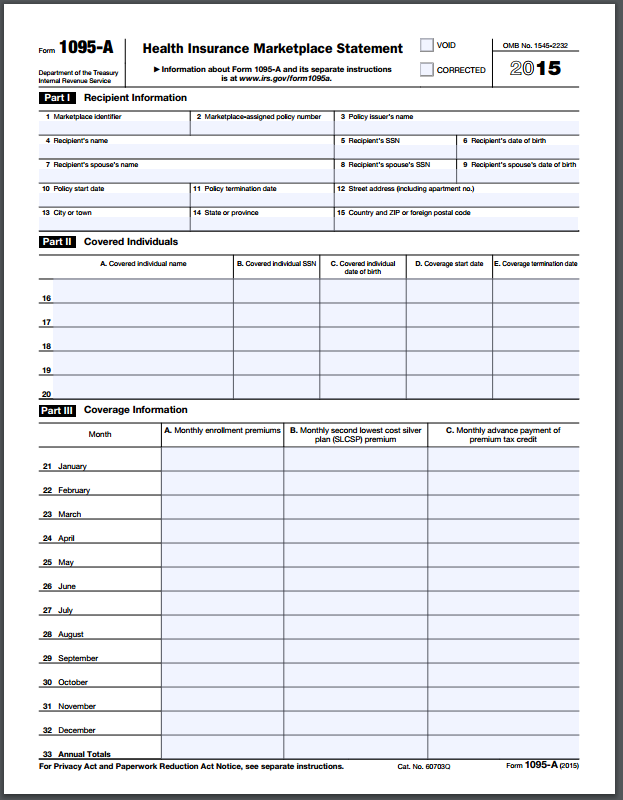

Form 1095 A Health Insurance Marketplace Statement 15 Edit Fill Sign Online Handypdf

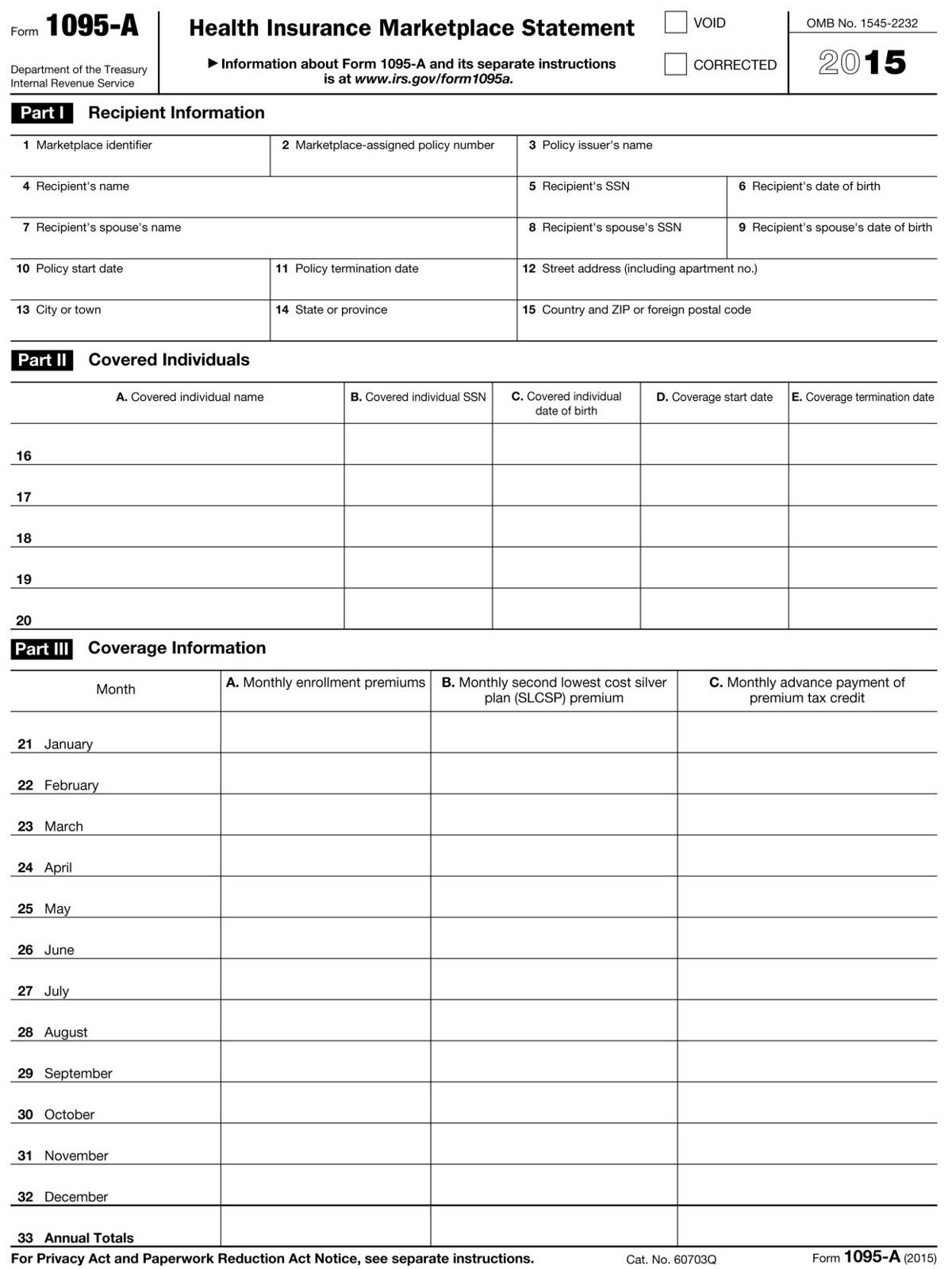

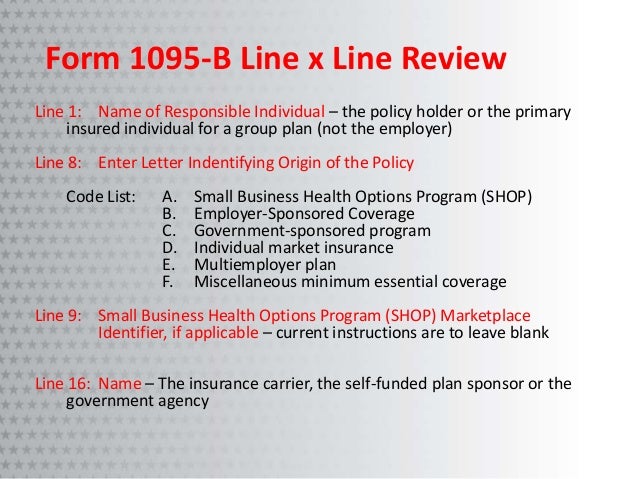

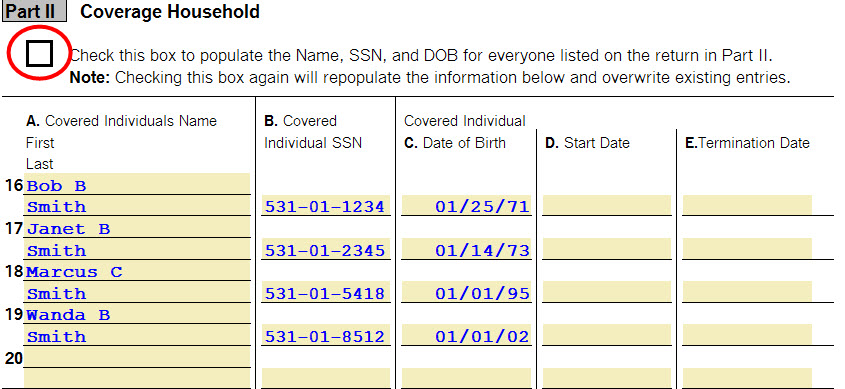

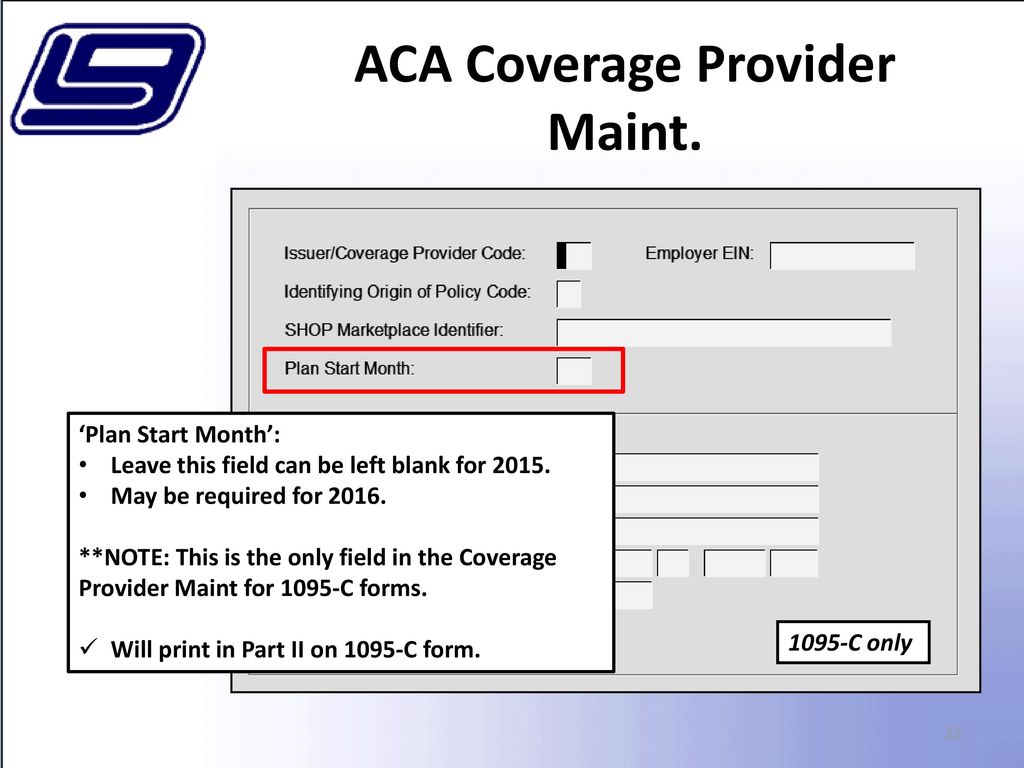

Line 9 Small Business Health Options Program (SHOP) marketplace identifier Line 9 identifies Small Business Health Options Programs (SHOPs), if applicable For 16 reporting, this line should be left blank Previous line 1 to 7; · Some people still haven't gotten their 1095A It could still be sent before April 15th, but the first step to getting the correct form is contacting the Marketplace and IRS The second step should be doublechecking for the form online wwwhealthCaregov/taxes;Form 1095B is a tax form that reports the type of health insurance coverage you have, any dependents covered by your insurance policy, and the period of coverage for the prior year This form is used to verify on your tax return that you and your dependents have at least minimum qualifying health insurance coverage

1095 A Tax Credits Subsidies For Form 62 Attaches To 1040 Covered Ca

62 Form

0224 · Every year Applicable Large Employers ("ALEs") must file Forms 1094C and 1095C with the IRS and furnish Forms 1095C to employees considered fulltime under the Affordable Care Act ("ACA") Forms 1094C and 1095C are used in combination with the IRS automated Affordable Care Act Compliance Validation (ACV) System to determine whether an ALE owesSolved Whats a Market Identifier Ttlcintuitcom DA 15 PA 50 MOZ Rank 67 Whats a Market Identifier?Call the Marketplace Call Center at TTY users should call

4 New Hardship Exemptions Let Consumers Avoid Aca Penalty For Not Having Health Insurancekaiser Health News

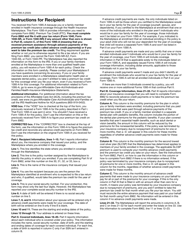

Form 1095 A Community Tax

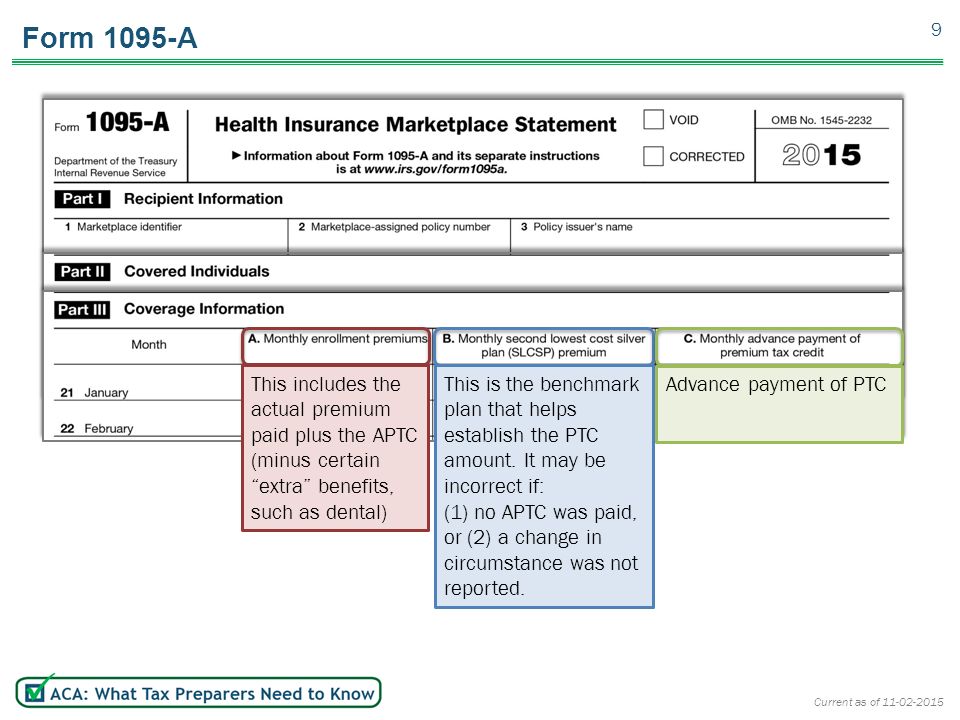

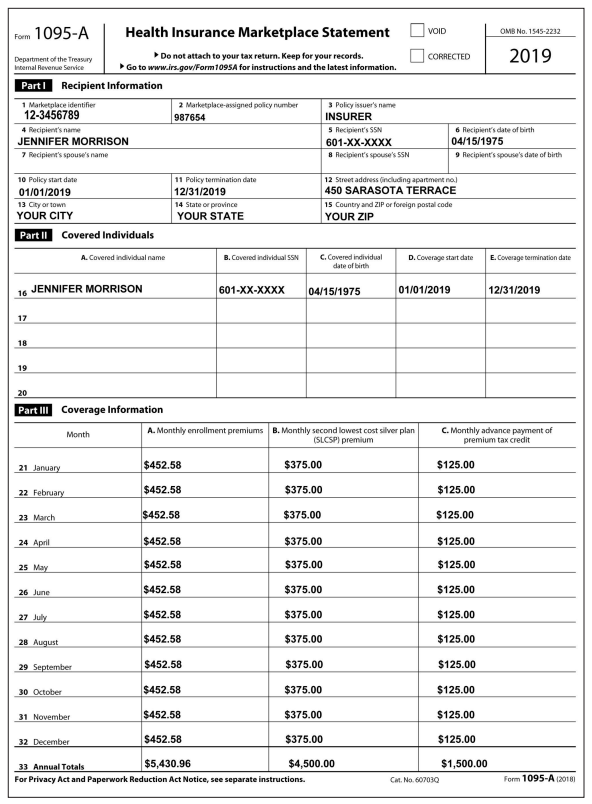

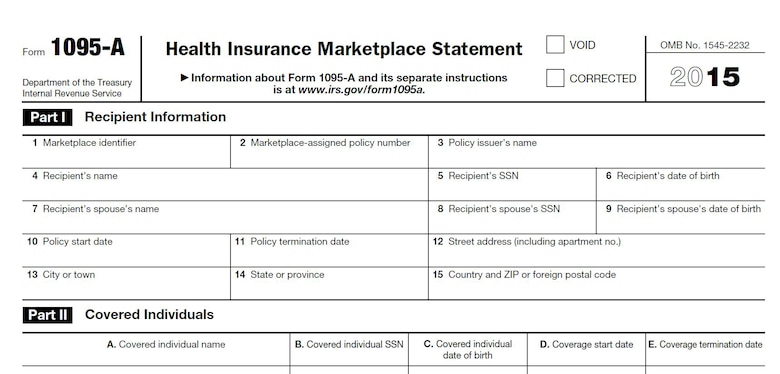

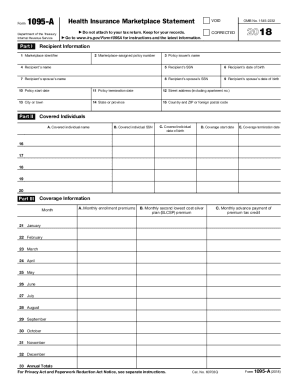

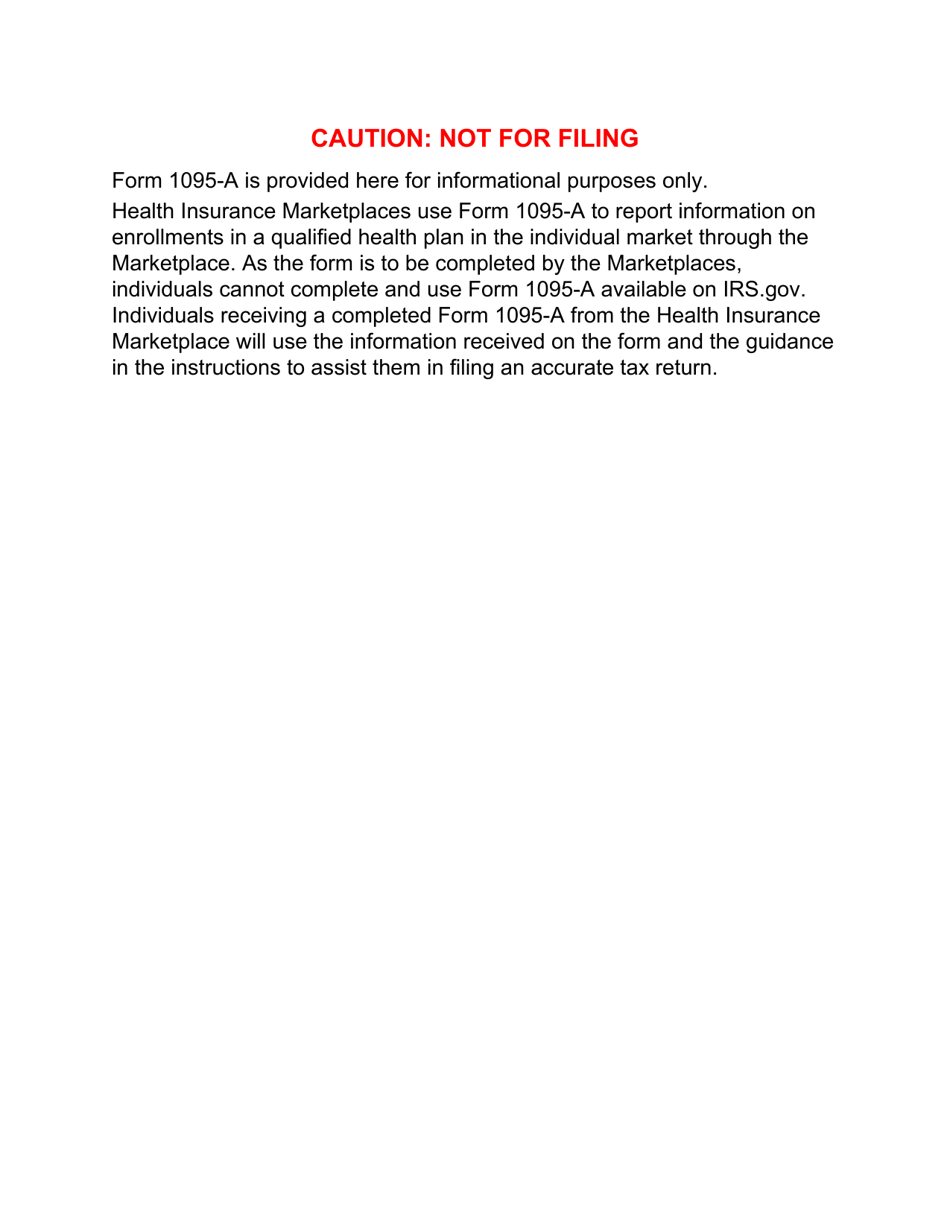

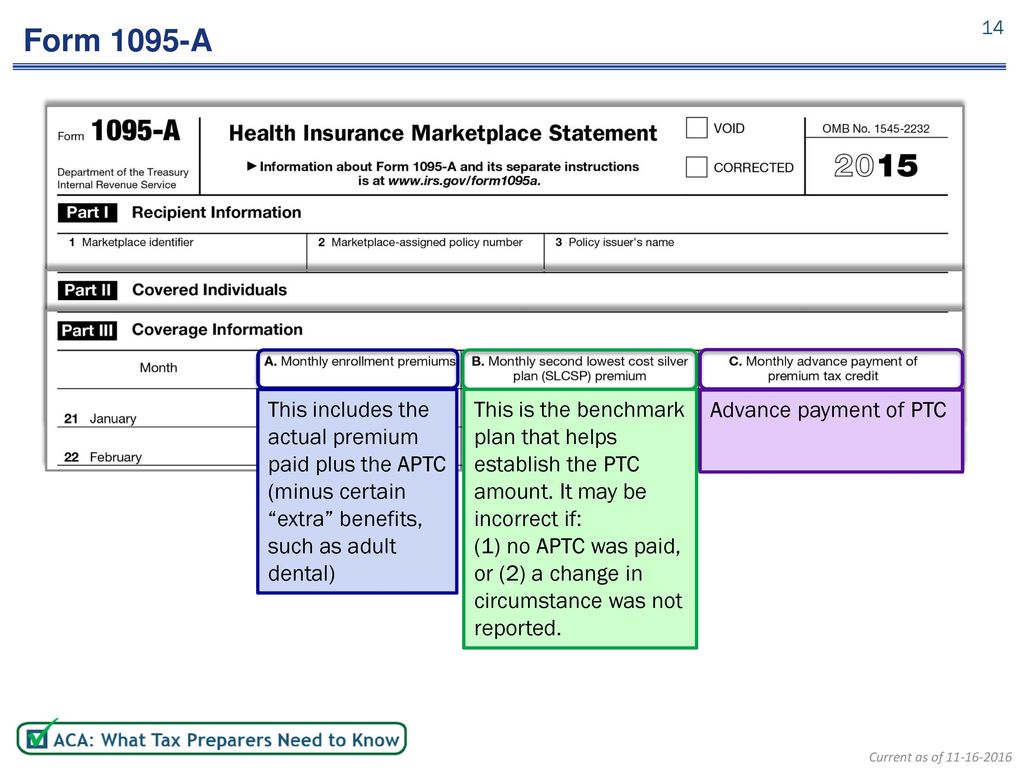

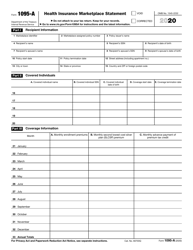

Forms 1095C those employees You will receive a copy of Form 1095C because you were a fulltime employee for all or some months of the prior calendar year You are receiving a copy of the Form 1095C so you know what information has been reported to the IRS about the offer of health coverage made to you and your familyDuring tax season, Covered California sends two forms to our members the federal IRS Form 1095A Health Insurance Marketplace Statement and the California Form FTB 35 California Health Insurance Marketplace Statement0814 · Your 1095A contains information about Marketplace plans any member of your household had in , including Premiums paid Premium tax credits used A figure called "second lowest cost Silver plan" (SLCSP) You'll use information from your 1095A to fill out Form 62, Premium Tax Credit (PDF, 110 KB)

Irs Form 1095 A Fill Out Printable Pdf Forms Online

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Form 1095A vs Form 1095C •1095A with PTC in months that 1095C shows affordable coverage?My 1095c doesnt say any of those it has my name ssn and my employer's name You can report theIf you bought health insurance through one of the Health Care Exchanges, also known as Marketplaces, you should receive a Form 1095A which provides information about your insurance policy, your premiums (the cost you pay for insurance), any advance payment of premium tax credit and the people in your household covered by the policy

15 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

What Is Form 1095 C And Do You Need It To File Your Taxes

Generally 1095B forms are filed by insurers for employers who use the SHOP, small selffunded groups, and individuals who get covered outside of the health insurance Marketplace 1095C forms are filed by large employers If they are selffunded, they just fill out all sections of 1095CMy 1095c doesnt say any of those it has my name ssn and my employer's name You do not report your Form 1095C on a tax return nor do you report the Form 1095C as a Form 1095A See this TurboTax support FAQ for a Form 1095C https//ttlcintuitForms 1095B and 1095C are not required with your Tax Return You are no longer required to report your health insurance on your return UNLESS you or a family member were enrolled in health insurance through the Marketplace and advance payments of the Premium Tax Credit were made to your insurance company to reduce your monthly premium payment

The Abcs Of Forms 1095 A 1095 B 1095 C American Exchange

Automated Ppaca And Irs Reporting

F Other designated Minimum Essential Coverage;Next line 10 to 15Partners Tax Professionals;

Form 1095 A Community Tax

Form 1095 C Guide For Employees Contact Us

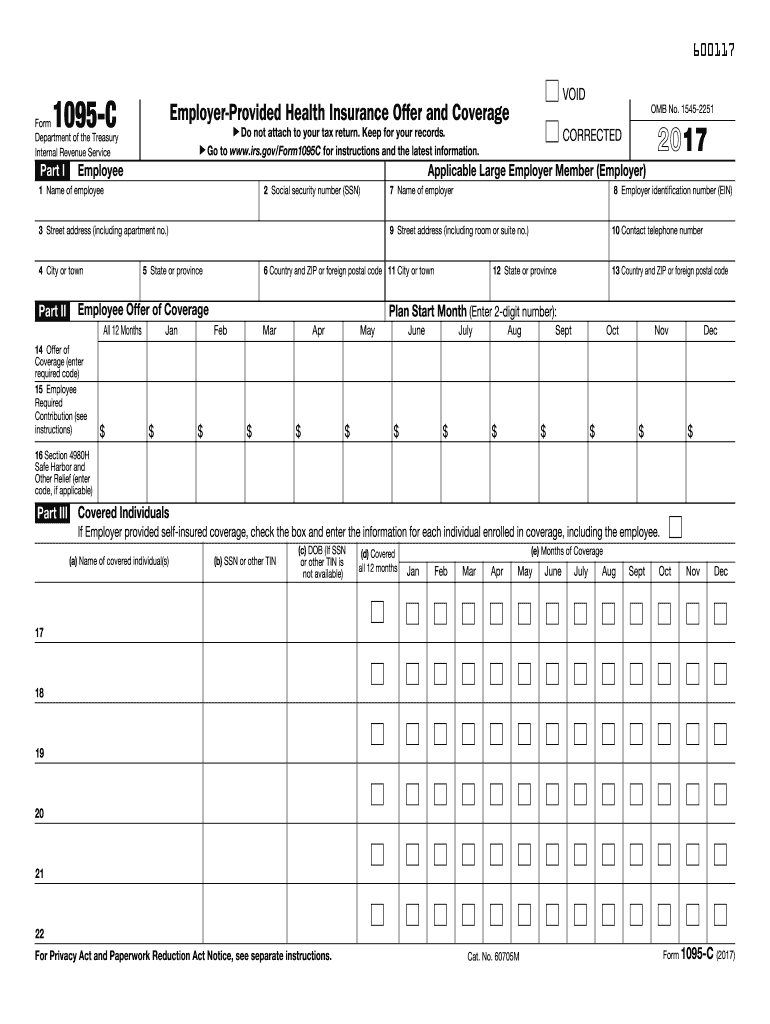

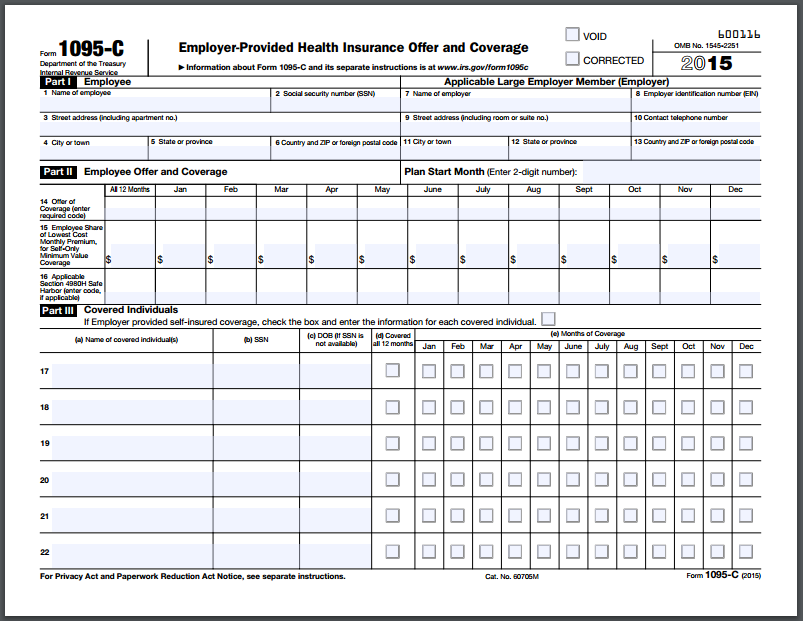

The individual does not need to send Form 10951916 · Type 1095C and click Create new copy Enter the Employer Name and click Create Check the box to indicate if owned by Taxpayer or Spouse Part I Employee Lines 1, 2, 3, 4, 5, and 6 will be completed based on the ownership box checked Line 7 is completed when entering the name of the Employer for the copy Line 8 EIN of the Employer · Form 1095C, EmployerProvided Health Insurance Offer and Coverage The IRS has posted a set of questions and answers about the Forms 1095A, 1095B and 1095C The questions and answers explain who should expect to receive the forms, how they can be used, and how to file with or without the forms

The Abcs Of Forms 1095 A 1095 B 1095 C American Exchange

Didn T Get A 1095 A Or Ecn You Can File Taxes Without Them

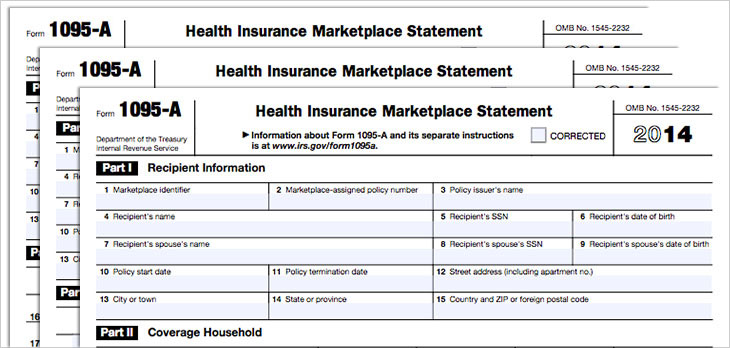

· Fill Online, Printable, Fillable, Blank Health Insurance Marketplace Statement Form 1095A Form Use Fill to complete blank online IRS pdf forms for free Once completed you can sign your fillable form or send for signing All forms are printable and downloadable Health Insurance Marketplace Statement Form 1095A · Form 1095C EmployerProvided Health Insurance Offer and Coverage Form 1095C is a tax form reporting information about an employee's health coverage offered by an Applicable Large Employer more1916 · Form 1095A is used to report certain information to the IRS about family members who enroll in a qualified health plan through the Marketplace Form 1095A also is furnished to individuals to allow them to claim the premium tax credit, to reconcile the credit on their returns with advance payments

1 0 9 5 A P R I N T A B L E F O R M Zonealarm Results

Form 1095 For The Affordable Health Care Act Editorial Stock Photo Image Of Form Revenue

The 1095C forms for 15 are now due to individuals by March 31, 16 Normally, forms 1094C and 1095C must be provided to the IRS by February 28th (March 31st, if filed electronically) of the year following the year to which the statement relatesACA Forms Form 1095B Form 1095C;And the marketplace assigned policy number???

Form 1095 A Community Tax

How To Delete 1095 A Form

The Submission ID and record identifier that you need to include in your corrected form 1094C/1095C internet file can be found on the 1094C/1095C Batch Worksheet that was displayed when the original 1094C and 1095C forms were created You can also use the following steps to locate the transmission information manuallyOFFICE OF LABOR RELATIONS 22 Cortlandt St 14th Floor, New York, NY nycgov/olr January 21 TO ALL CITY, CUNY COMMUNITY COLLEGES, WATER AUTHORITY, AND HOUSING AUTHORITY EMPLOYEES FROM THE NEW YORK CITY OFFICE OF LABOR RELATIONS (OLR) EMPLOYEE BENEFITS PROGRAM SUBJECT FORM 1095C INFORMATION The followingSearch the world's information, including webpages, images, videos and more Google has many special features to help you find exactly what you're looking for

Irs Form 1095 A Download Printable Pdf Or Fill Online Health Insurance Marketplace Statement Templateroller

15 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

Enjoy millions of the latest Android apps, games, music, movies, TV, books, magazines & more Anytime, anywhere, across your devices · Depending on types of insurance coverage for healthcare, you might receive to use a Form 1095 Review this guide of Form 1095 requirements from H&R BlockSee the Instructions for Forms 1094C and 1095C for more information about who must file Forms 1094C and 1095C and for more information about reporting coverage for nonemployees Small employers that aren't subject to the employer shared responsibility provisions sponsoring selfinsured group health plans will use Forms 1094B and 1095B to report information about

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Form 1095 is sent to the individual by whoever provides them with health insurance, be it the health insurance marketplace for Form 1095A, a small selffunded group or small business for Form 1095B, or by their (50 fulltime employees) employer for Form 1095C Form 1095 is only sent to the individual and for his or her own reference;All fulltime employees at companies with more than 50 fulltime employees will now receive a Form 1095C to report health care coverage offered by their empIf you received health insurance outside of the marketplace exchanges in 16, and worked for a large employer, look for Form 1095C, EmployerProvided Health Insurance Offer and Coverage, to arrive in your mailbox Employers have until January 31, 17 to distribute the form

Form 1095 A 1095 B 1095 C And Instructions

Form 1095 For The Affordable Health Care Act Editorial Stock Photo Image Of Form Revenue

Information on 1095C might be relevant if you had to purchase health insurance via the marketplace (see 1095A below) If you do wish to claim the premium tax credit you, will need Part II of Form 1095C this only applies if you purchased additional healthcare through the marketplace and received a 1095A1107 · Form 1095C is sent out to those who enrolled in a health plan through the Health Insurance Marketplace In 21, you will be furnished with a Form 1095C reporting the information you need to know about the plan you enrolled inYou will receive a 1095C if coverage was provided by your employer Who receives a Form 1095C?

2 3 86 Command Code Irpol Internal Revenue Service

Part Ii Advanced Certification Ppt Download

· Who Has to File 1095B and 1095C Forms?02 · Box 1 Form 1095A Marketplace identifier is a unique 14character identifier that is a combination of numbers and/or letters, it is not an abbreviation of your state Your Form 1095A should have this number in box 1 Use the marketplace identifier inForm 1095A comes from the Marketplace Individuals will receive Form 1095C if they

How To Get Form 1095 A Health Insurance Marketplace Statement Picshealth

What Is Form 1095 C And Do You Need It To File Your Taxes

Form 1095 A Fill out, securely sign, print or email your 1095 a 10 form instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start aUse the information contained in the 1095C to assist you in determining in you are eligible for the premium tax credit If you enrolled in a health plan in the Marketplace, you may need the information in Part II of Form 1095C to help determine your eligibility for the premium tax creditTax loss greater than $3,000 Paid $75K for physical metal but received only $2K worth for a $73K loss I am 78 years old, so being able to claim $3K per year for 24 years is useless Have a one time income of $55K (normal annual income is only $13K), but looks like I

Health Insurance Report Form 1095 A 1095 B And 1095 C

15 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

B1 Understanding the Sources for Forms 1095C and 1094C and1095C XML The Form 1095C print and the 1094C or 1095C XML files are handled through the JD Edwards Electronic Document Delivery (EDD) system The system uses the data item aliases during the spool file batch export step to create XML source files, which are then used to map the information to–Must ask the TP about circumstances –Note Questions 13 & 14, Questions and Answers on the Premium Tax Credit, on irsgov •ER coverage is affordable if premiums for selfonly coverage ≤ 966% HHI (16)

Irs Form 1095 A Fill Out Printable Pdf Forms Online

Form 1095 A 1095 B 1095 C And Instructions

14 How Do Jennifer S Educator Expenses Affect Her Chegg Com

F 1095

The Affordable Care Act Taxes A Resource For

1095 A Form Fill Out And Sign Printable Pdf Template Signnow

355 Forms Health Insurance Photos Free Royalty Free Stock Photos From Dreamstime

Aca Compliance Reporting Morris Reynolds Insurance

Cengage Resource Center

Tax Season Complicated By New Health Insurance Forms Health Bendbulletin Com

Irs Form 1095 A Download Printable Pdf Or Fill Online Health Insurance Marketplace Statement Templateroller

Covered California Ftb 35 And 1095a Statements

Form 1095 A 1095 B 1095 C And Instructions

The Abcs Of Forms 1095 A 1095 B 1095 C American Exchange

Ppaca Employer Reporting Requirements Ce Presentation Client Presen

Welcome To Aca Compliance

Application Id Healthcare Gov Glossary Healthcare Gov

The Abcs Of Forms 1095 A 1095 B 1095 C American Exchange

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png)

About Form 1095 A Health Insurance Marketplace Statement Definition

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Vita Tce Advanced Topic Ppt Download

17 Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Irs Form 1095 Form Ftb 35 And Your Health Insurance Subsidy

Form 1095 A 1095 B 1095 C And Instructions

State Health Insurance Markets Struggle With Cost Challenges

How To Get Form 1095 A Health Insurance Marketplace Statement Picshealth

F 1095

Tax Season Is Here Know Your Forms Enroll Nebraska

Ppaca Employer Reporting Requirements Ce Presentation Client Presen

Covered California Ftb 35 And 1095a Statements

How To Get Marketplace 1095 Form

Entering Form 1095 A 1095 B Or 1095 C Health Cove Intuit Accountants Community

Sc Thrive 1095 Forms Are Health Insurance Statements

15 Form Irs 1095 A Fill Online Printable Fillable Blank Pdffiller

Irs Form 1095 A Download Printable Pdf Or Fill Online Health Insurance Marketplace Statement Templateroller

Irs Issues Drafts Of Forms 1094 C 1095 B And 1095 C For 16 Casetext

The Health Insurance Marketplace

1095 A Tax Form H R Block

Covered Ca And Your Taxes What Is Form 1095 A Clark Irish Insurance

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Obamacare Tax Forms In The Time Of Coronavirus Don T Mess With Taxes

How To Get Health Insurance Marketplace Statement

Annual Health Care Coverage Statements

What Are 1095 Tax Forms San Diego Sharp Health News

1095 A Tax Credits Subsidies For Form 62 Attaches To 1040 Covered Ca

Obamacare Tax Forms In The Time Of Coronavirus Don T Mess With Taxes

Zortec Payroll Affordable Care Act Ppt Download

0 件のコメント:

コメントを投稿