Section 1031 of the US tax code permits deferral of taxes due when business property is sold to raise cash for reinvestment in other property Your 1031 Exchange property must be within the USA as no foreign country properties may be used BENEFITS OF A 1031 EXCHANGE If growing your real estate investment portfolio is a part of your wealth strategy then using 1031 Exchange gives you the ability to defer capital gains tax What is a 1031 exchange?

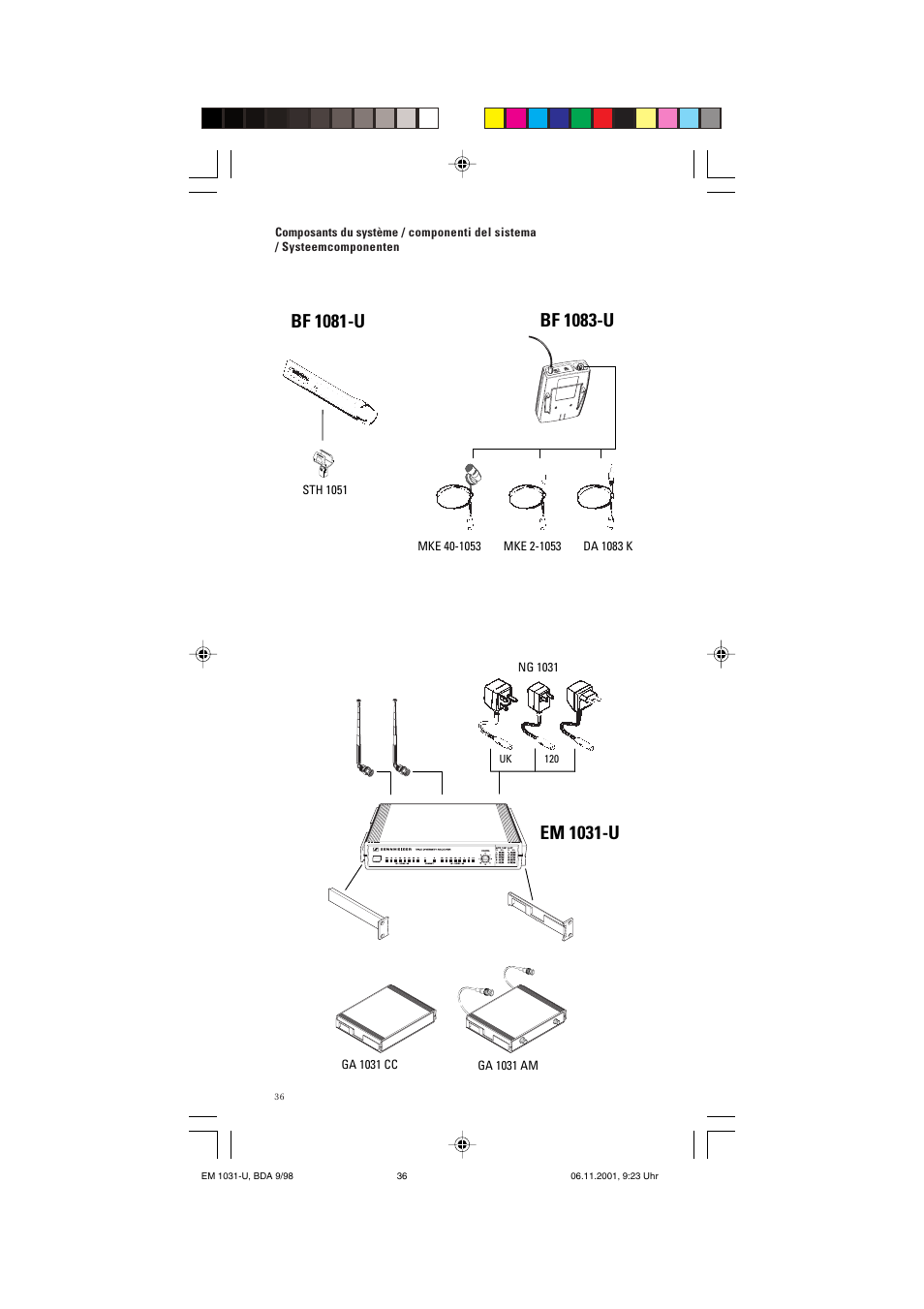

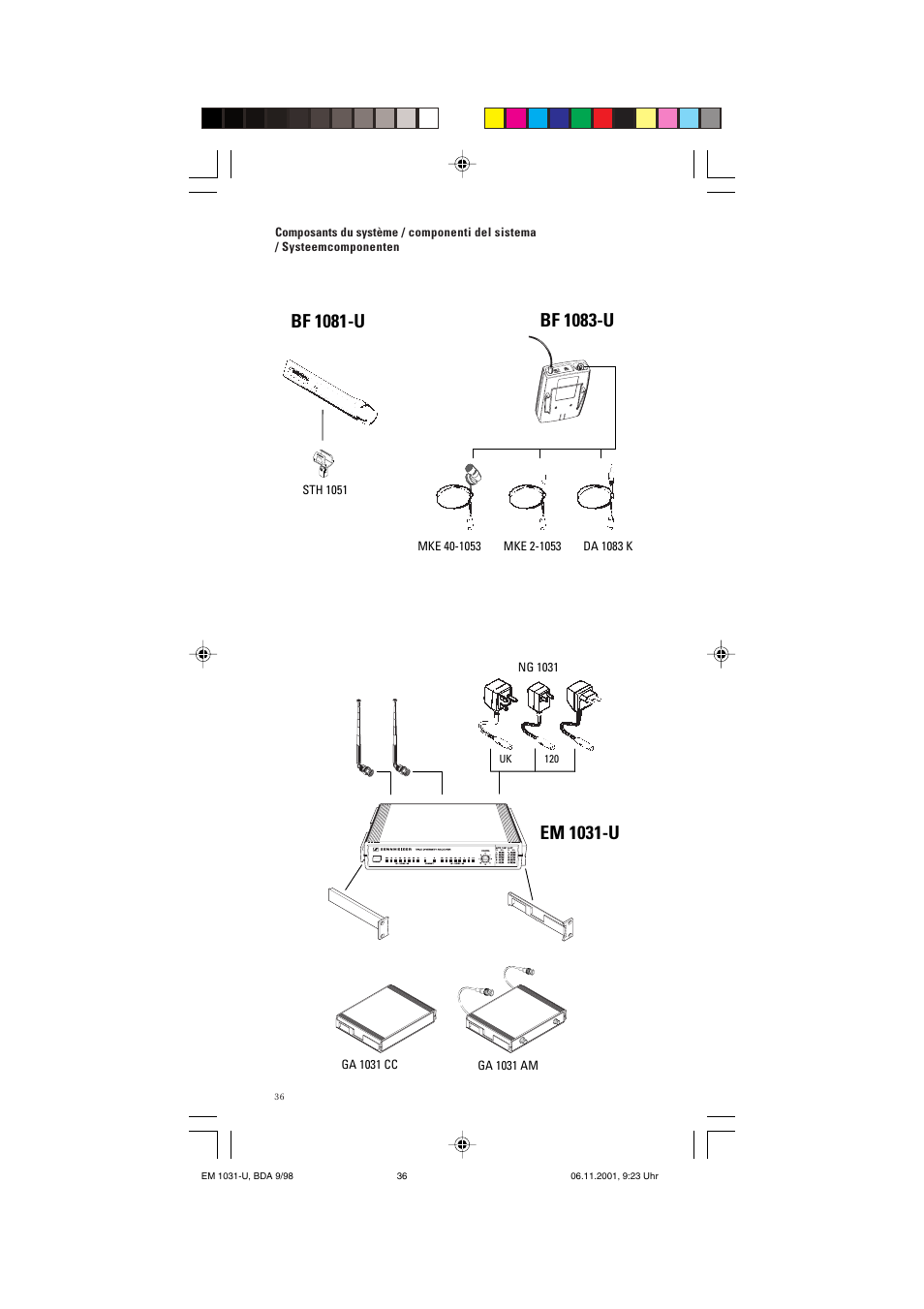

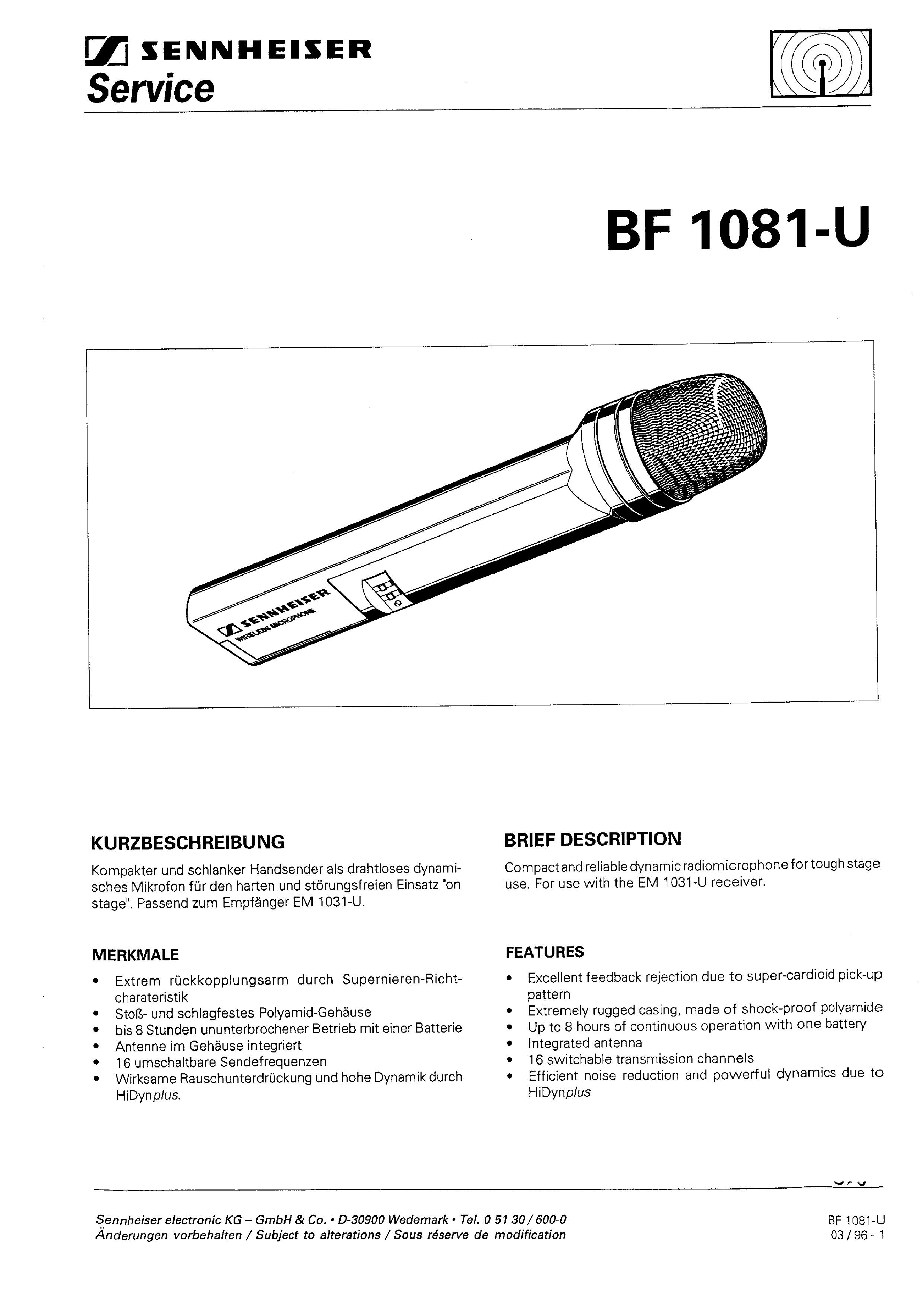

Bf 10 U Bf 1081 U Em 1031 U Sennheiser Receiver Em 1031 U User Manual Page 36 40

Setting up a 1031 exchange account

Setting up a 1031 exchange account-The manual describes functions of A 1031 U, tells how to use it correctly and includes instructions on maintanance Owner's manual usually has installation instructions, set up guide, adjustment tips, trubleshooting guide and specification sheet This is where tax planning gets interesting While you cannot enter into a taxdeferred section 1031 exchange directly with stocks, bonds, etc you may be able to achieve similar results with code section 721 Code section 721 states that if you contribute property for an interest in a partnership, it is taxfree to the extent the only property received in exchange is an interest

Sennheiser A 1031 U Omnidirectional Uhf Antenna A 1031 U B H

1031 exchanges require a certain purchase price and debt structure There are two main rules when it comes to the financial requirements of a 1031 exchange First, the purchase price of the property or properties you buy must equal or exceed the sale price of the property or properties that you sellWhat Qualifies as LikeKind Property?Section 1031 is taxdeferred, but it is not taxfree The exchange can include likekind property exclusively or it can include likekind property along with

Well, it's pretty much anyWho can do a 1031 exchange?Because for about 100 years, the 1031 exchange has allowed real estate investors the chance to reinvest the profits from the sale of a property without having to pay capital gains tax

Summary In this article, you'll learn how to do a 1031 exchange with real estate in the year 21 including the most important rules to follow as a real estate investor and 1031 exchange success stories to inspire youNote To improve the experience of this page, we've broken out this article into a series of shorter articles that we hope will be much easier to digest§1031 Administration of oath The President, the VicePresident, the Secretary of Defense, any commissioned officer, and any other person designated under regulations prescribed by the Secretary of Defense may administer any oath(1) required for the enlistment or appointment of any person in the armed forces; "The term '1031 exchange' gets its name from the Internal Revenue Service code, Section 1031," says Eachan Fletcher, CEO and cofounder

Sennheiser c 1031 Rain Cover For A 1031 U Antenna c 1031 B H

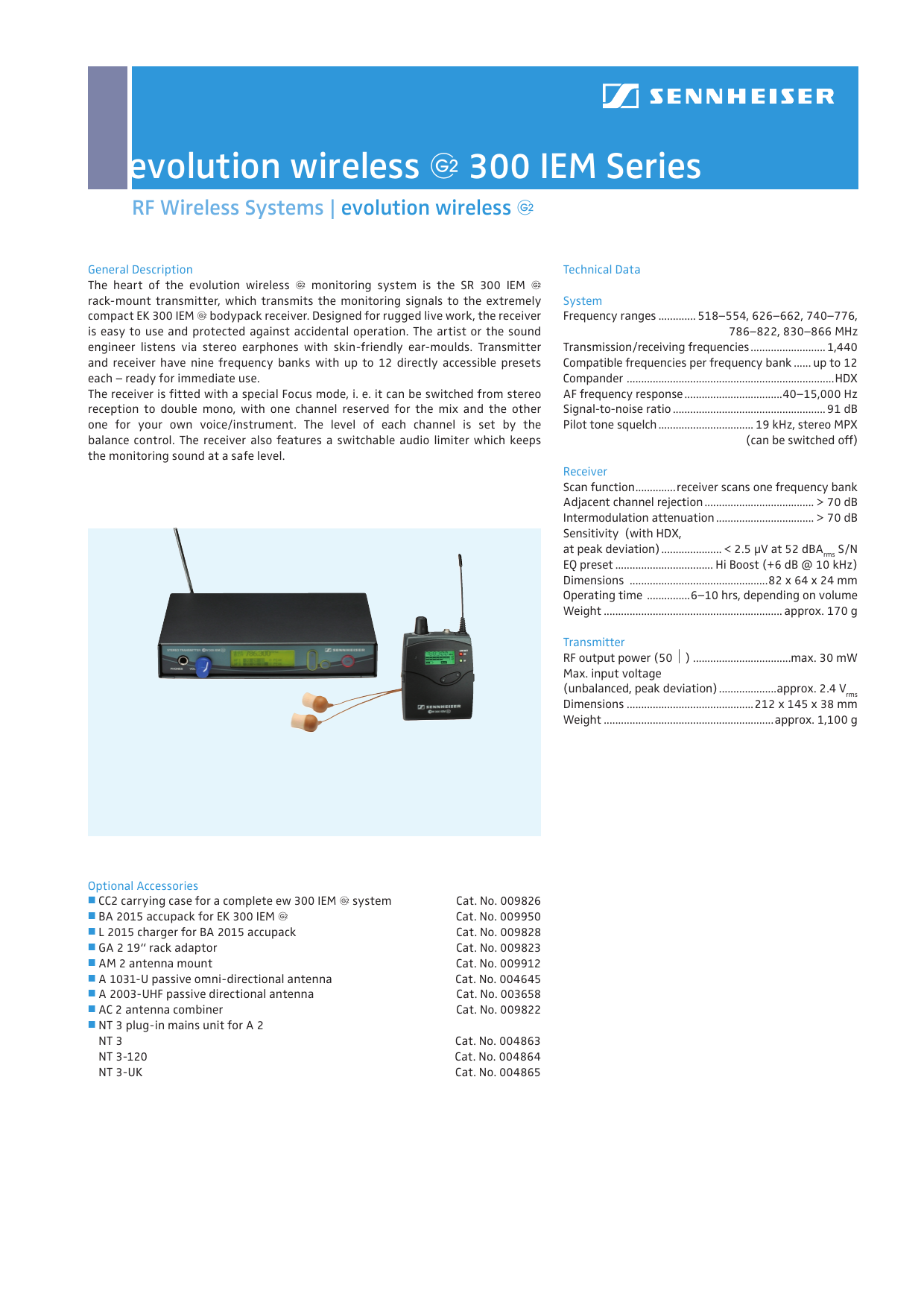

Sennheiser Em 1031 U True Diversity Wireless Microphone Receiver Pair 674 698mhz Av Gear

A "1031 exchange" is the nickname used to discuss Section 1031 of the US Internal Revenue Service's tax code This section states that if an individual exchanges one investment property for another via a 1031 exchange, they may be able to defer capital gains (or losses) that they would otherwise have to pay at time of saleA 1031U Add to compare Image is for illustrative purposes only Please refer to product description Manufacturer SENNHEISER SENNHEISER Manufacturer Part No A 1031U Order Code MP Also Known As GTIN UPC EAN Technical Datasheet A 1031U Datasheet Catalogue page A 1031 likekind exchange is a part of the US tax code that allows for investment property, real estate or otherwise, to be exchanged for similar investment property You can exchange a piece of factory equipment for another piece of factory equipment or you can exchange a commercial building for a residential apartment building

Sennheiser A 1031 U Wideband Passive Omni Directional Uhf Antenna

Upbright Adapter Fits Sennheiser Ng 1031 1 Art Nr For Bfr 1051 Em 1031 U True Diversity Uhf Wireless Mic Receiver Class 2 Transformer World Wide Use Power Supply Walmart Com Walmart Com

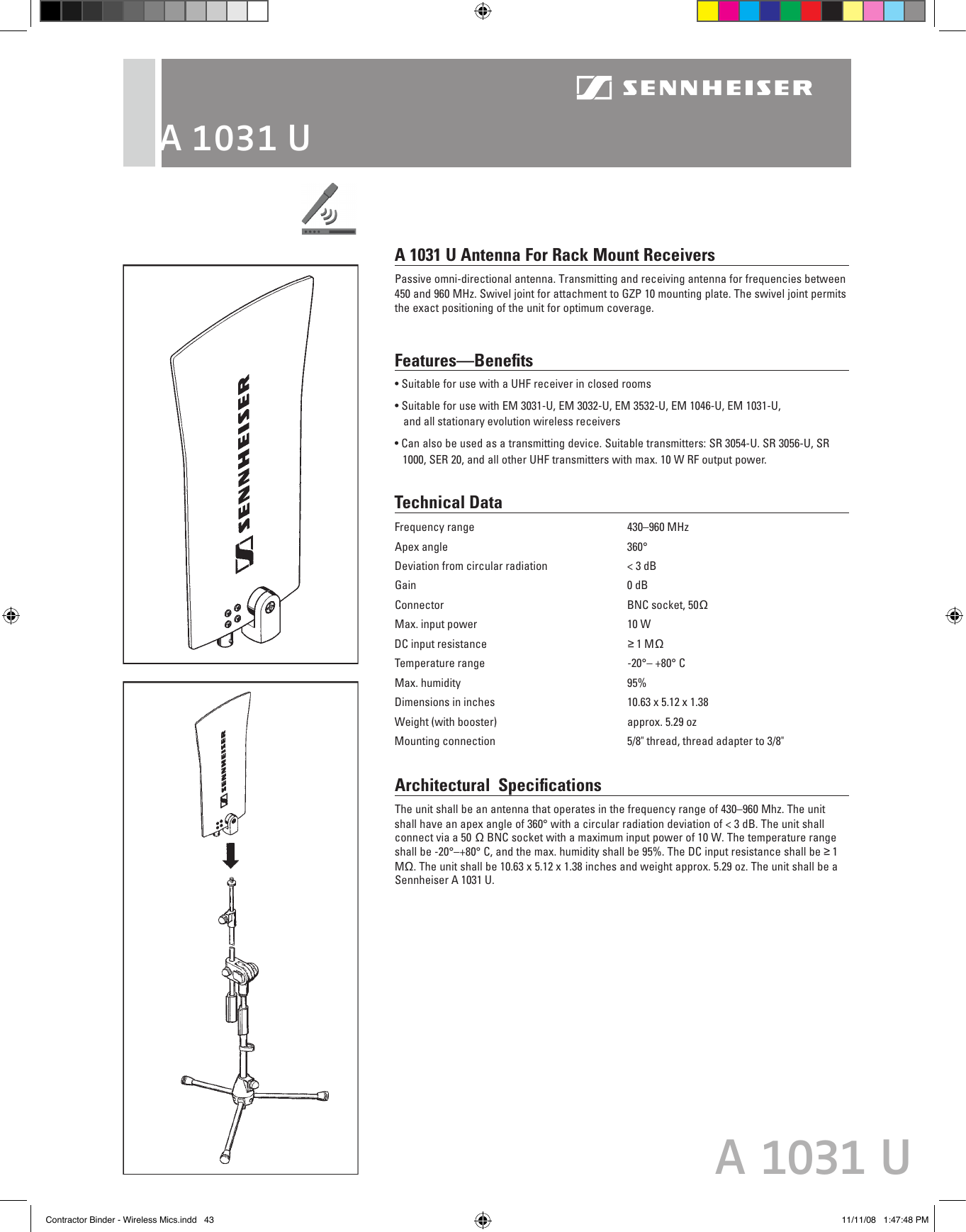

A 1031U Passive wideband receiving antenna, horizontal omnidirectional radiation pattern, vertical approximate figureofeight radiation pattern AREAS OF APPLICATION • Suitable for use in conjunction with a UHF receiver in closed rooms The output DC supply voltage from the receiver cannot be shortcircuitedAlso known as the Starker Exchange, the 1031 exchange defers taxes on exchanges of likekind real estate In simple terms, it allows real estate investors to defer taxes on profits of properties sold to raise cash for purchasing other properties A 1031 exchange gets its name from Section 1031 of the US Internal Revenue Code, How does a 1031 exchange benefit investors?

Sennheiser A 1031 U Omnidirectional Uhf Antenna A 1031 U B H

Bf 10 U Bf 1081 U Em 1031 U Sennheiser Receiver Em 1031 U User Manual Page 36 40

Miscellaneous Qualified Intermediary Information A qualified intermediary (QI) is any foreign intermediary (or foreign branch of a US intermediary) that has entered into a qualified intermediary withholding agreement with the IRS You may treat a QI as a exempt payee to the extent the QI assumes primary withholding responsibility and primary Boiling it down, the real property that qualifies for a 1031 exchange is property used for business or investment within the US and it doesn't matter the number of properties we're talking about as long as it's of equal or greater value But who qualifies for a 1031 exchange?Suitable for use with EM 3031U, EM 3032U, EM 3532U, EM 1046U, EM 1031U, and all stationary evolution wireless receivers Country of origin is Germany New &

Sennheiser Em 1031 U True Diversity Receiver 801 100 Reverb

West Auctions Auction Surplus Auction Of Vehicles Sound Lighting And Production Equipment Item 2 Sennheiser A 1031 U Passive Omni Directional Antenna

A 1031 property exchange is a type of "likekind" exchange that's permitted under Section 1031 of the US tax code The law allows businesses to sell real property and then postpone paying tax on the gain if they invest the proceeds in another similar property 1 The simplest type of 1031 exchange involves a simultaneous swap of oneA 1031 U Antenna For Rack Mount Receivers Passive omnidirectional antenna Transmitting and receiving antenna for frequencies between 450 and 960 MHz Swivel joint for attachment to GZP 10 mounting plate The swivel joint permits the exact positioning of the unit for optimum coverage Features—Benefits"This subtitle subtitle C (§§ 1031–1037), enacting this part shall take effect on the designated transfer date" The term " designated transfer date " is defined in section 5481(9) of this title as the date established under section 55 of this title

Microphones Wireless Valley Tech Production Group Ltd

Hf Evolution G2 Serien Gb Freq City Sound Lighting Manualzz

The Sennheiser A 1031U is a passive omnidirectional antenna for radio microphone systems transmitting and receiving frequencies between 450 and 960 MHz This website requires cookies to provide all of its features A Guide to 1031 Exchanges A 1031 exchange can help you defer capital gains taxes on investment property, but the rules are complicated The 1031 exchange can be particularly helpful if you want What is Section 1031 of the US IRS's tax code?

Sennheiser A1031u Omni Antenna Cue Sale

Fullcompass Com

Named after section 1031 of the US Internal Revenue Code, a 1031 exchange is a procedure that allows an owner of appreciated real estate to exchange that property for an alternative "likekind" property while deferring capital gainsDS1031A 0719 9 First Name of Spouse 12 Legal Residence 14 Residence at time of employment 15 Home leave residence Code 16 Residence for Service separation 19 Marriage Date Place Dependents other than spouse who will travel with you at Government expense and reside abroad with you 17 Spouse's professional field Attended (LastTo defer paying capital gains taxes using a 1031 likekind exchange, your replacement property must be of the same kind as the property sold You also must hold both properties for business, productive use in a trade, or investment (26 USC § 1031(a))

Page 17 Of Sennheiser Stereo Receiver Em 1031 U User Guide Manualsonline Com

Sennheiser A 1031 U 3d Warehouse

A 1031 exchange, or "likekind" exchange, is a method of exchanging investment properties that allows you to defer capital gains tax Referred to by its namesake, IRS Code Section 1031, the bill was passed in 1921 to encourage active reinvestment by giving investors the ability to avoid taxation of ongoing investment property A 1031 exchange, named after section 1031 of the US Internal Revenue Code, is a way to postpone capital gains tax on the sale of a business or investment property by using the proceeds to buy aHome > Commercial/Industrial Combustion > Flame Detectors Commercial > Ultraviolet > C7027 > C7027A1031/U Industrial Combustion Industrial Combustion Training Videos Traing and Development Training and Development Portal Industrial Products Find a Distributor NonStandard Returns

1

Amazon Com Transtar 1031 Mul Tie Adhesion Promoter 1 Gallon Automotive

Section 1031 of the US tax code covers likekind exchanges of real property Investment properties are subject to capital gains tax, however, those taxes are deferred until the property is sold A 1031 exchange allows for a property owner to sell one asset and buy another, while maintaining the taxdeferred status The 3 Property Rule (and Other Rules) of 1031 Exchanges The 1031 exchange can help you defer capital gains tax while you reinvest the profits from an initial investment into a new property, or a series of them But investors must be careful to follow a few important rules, or risk losing those tax advantagesUnder Section 1031 of the United States Internal Revenue Code (26 USC § 1031), a taxpayer may defer recognition of capital gains and related federal income tax liability on the exchange of certain types of property, a process known as a 1031 exchangeIn 1979, this treatment was expanded by the courts to include nonsimultaneous sale and purchase of real estate, a process sometimes

Sennheiser A 1031 U Uhf Omnidirectional Antenna Nagrit Srl

Ac3kwd Antenna Combiner User Manual Sennheiser Active Antenna Splitter 2 X 1 8 Sennheiser Electronic Ny

The Certificate of Citizenship is, as the name implies, a document that proves that the exchanger is a US citizen This is not to suggest that a foreign entity can't participate in a likekind exchange But an exchanger's foreign status can create some extra issues and complications, which would need to be addressed Form 841031 Taxdeferred Exchanges have been around since Congress passed the Revenue Act of 1921 The actual law is found in 26 US Code Section 1031 of the Internal Revenue Code Under Section 1031, the law specifically states that "a taxpayer may defer recognition of capital gains and related federal income tax liability on theVirgin Islands Section 7701 of the Internal Revenue Code (IRC) defines the borders of the United States as all fifty states and the District of Columbia The Internal Revenue Service defined the borders of the US to include the US Virgin Islands for 1031 eligibility given the Exchange or is (1) A citizen or resident of the United States

Sennheiser Antenna A 1031 U

Sennheiser A 1031 U Passive Rundstrahlantenne Sende Und Empfangsantenne

Notice 23 addresses the threat posed by the COVID19 crisis to real estate investors' ability to complete ongoing likekind exchanges under Section 1031 of the Internal Revenue Code (the Code) by extending the deadlines applicable to a taxpayer's identification and purchase of replacement property (in a "forward" or traditional exchange), or identification andA 1031 exchange gets its name from Section 1031 of the US Internal Revenue Code, which allows you to avoid paying capital gains taxes when you sell an investment property and reinvest the proceeds from the sale within certain time limits in a property or properties of like kind and equal or greater value The Role of Qualified Intermediaries If you're a real estate investor, the 1031 exchange—which gets its name from Section 1031 of the US Internal Revenue Code—is your best friend!

A 1031 U Passive Omni Directional Antenna Av Store Professional Sound Lighting Video

Sennheiser A 1031 U Wideband Passive Omni Directional Uhf Antenna

Paragraph (2)(D) of section 1031(a) of the Internal Revenue Code of 1986 formerly IRC 1954 (as amended by subsection (a)) shall not apply in the case of any exchange pursuant to a binding contract in effect on , and at all times thereafter before the exchangeNorth American Title 1031 Exchange A likekind exchange is permitted under Section 1031 of the US Internal Revenue Code if it is an armslength transaction, meaning the seller or exchanger never has access to the proceeds from the sale It allows an investor who holds property "for productive use in trade or business or for investmentA 1031 exchange allows investors to shift any profit from the quick (hopefully!) sale of one investment property to the purchase of another to avoid paying the dreaded capital gains (or depreciation recapture!) taxes

West Auctions Auction Surplus Auction Of Vehicles Sound Lighting And Production Equipment Item 2 Sennheiser A 1031 U Passive Omni Directional Antenna

Sennheiser A1031 U Passive Omnidirectional Antenna Sweetwater

21% Off Sennheiser A 1031U Wideband Passive Omnidirectional UHF Antenna for Evolution Rackmount Receivers/RF Amplifiers, MHz Frequency Range, Each Buy now & save $40Home > Commercial/Industrial Combustion > Gas Valves > Fluid Actuator > V4055A,B,D,E > V4055A1031/U Industrial Combustion Industrial Combustion Training Videos Traing and Development Training and Development Portal Industrial Products Find a Distributor NonStandard Returns Previous Item 2 Of 22 What is a 1031 TaxDeferred Exchange?

Sennheiser A 1031 U Passive Omni Directional Antenna Reverb

Ptb 00 Atex 1031 U R Stahl

Sennheiser A 1031 U Passive Omni Directional Antennas 00 Picclick Uk

Rent Sennheiser A 1031 U Patriot Rental

Bsbroadcast Com

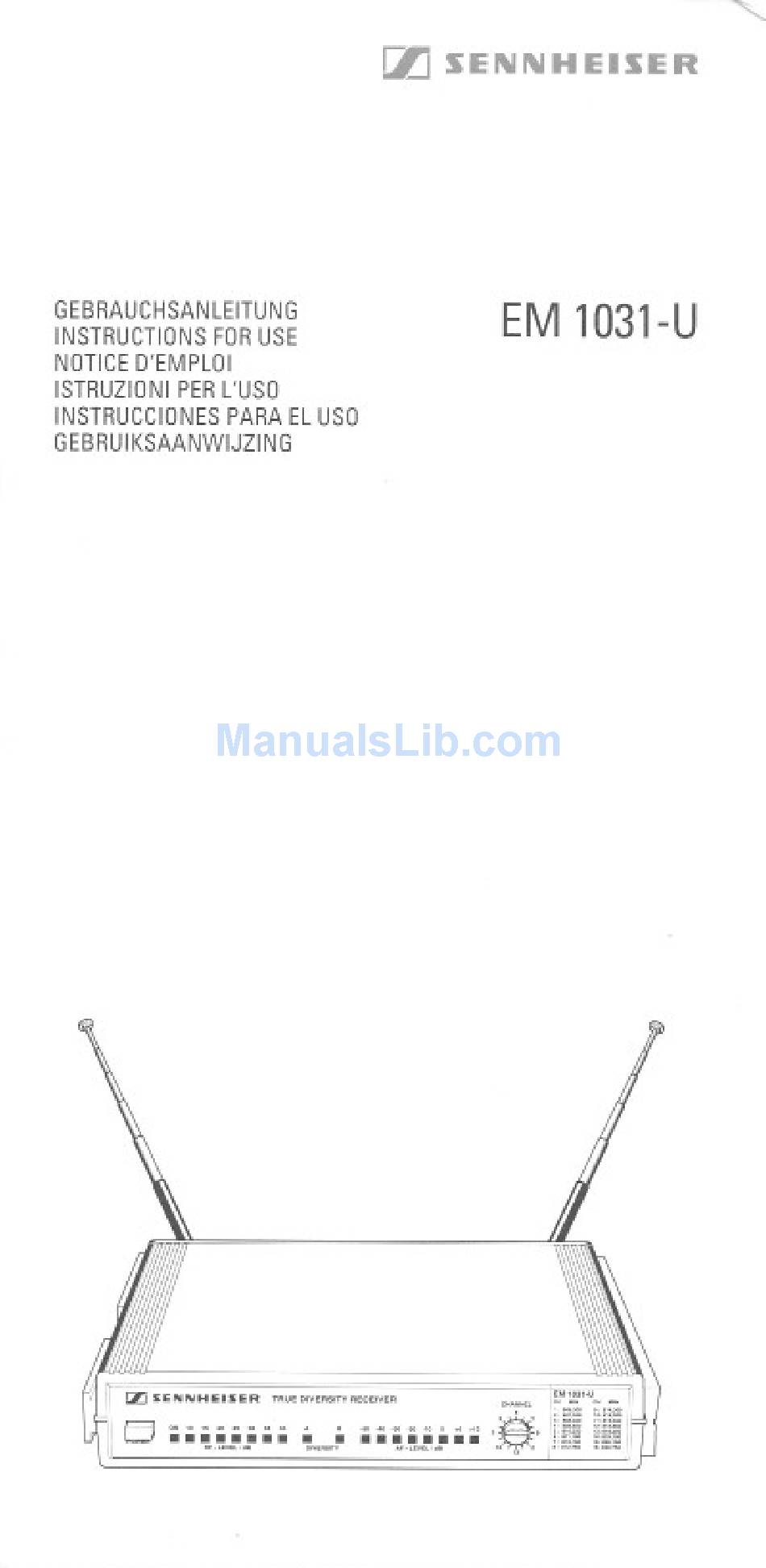

Sennheiser Em 1031 U Manuals Manualslib

Sennheiser A 1031 U Passive Omni Directional Antenna

Sennheiser A 1031 U Omnidirectional Wireless Antenna Studiospares

Hire Sennheiser A1031 Omni Directional Antenna

Sennheiser A1031 U Omni Directional Antenna 430 960 Mhz For Sale Online Ebay

Bestpixtajpvfn8 最も人気のある Sennheiser A 1031 U Datasheet Pdf Sennheiser A 1031 U Datasheet Pdf

Sennheiser Wideband Passive Omnidirectional Uhf Antenna

Em 1031 U By Sennheiser Buy Or Repair At Radwell Radwell Com

Sennheiser A 1031 U Passive Omni Directional Antenna

Sennheiser Em 1031 U True Diversity Wireless Microphone Receiver Pair 674 Ebay

A 1031 U Areas Of Application Technical Data U Mounting Sennheiser A 1031 U Instructions For Use Page 3

Lot Of 2 Sennheiser Em 1031 U Receiver Skp 30 U Wireless Plug On Transmitter 399 07 Picclick

Sennheiser Asa 3000 Users Manual Ac Gb

Two Sennheiser A 1031 U Omni Directional Paddle Antennas A1031 U A1031u

Sennheiser Vsm1 Schematic B112 0 Pdf

Service Manual For Sennheiser Bf1081 U Download

Sennheiser A 1031 U Passive Omni Antennae W Ab3 A1 Booster Pair Ebay

Page 13 Of Sennheiser Stereo Receiver Em 1031 U User Guide Manualsonline Com

Sennheiser Em 1031 U Instructions For Use Manual Pdf Download Manualslib

Sennheiser A 1031 U Antenna A 1031 U Sound Concepts Ar

Sennheiser Em 1031 U Manual Pdf Download Manualslib

1

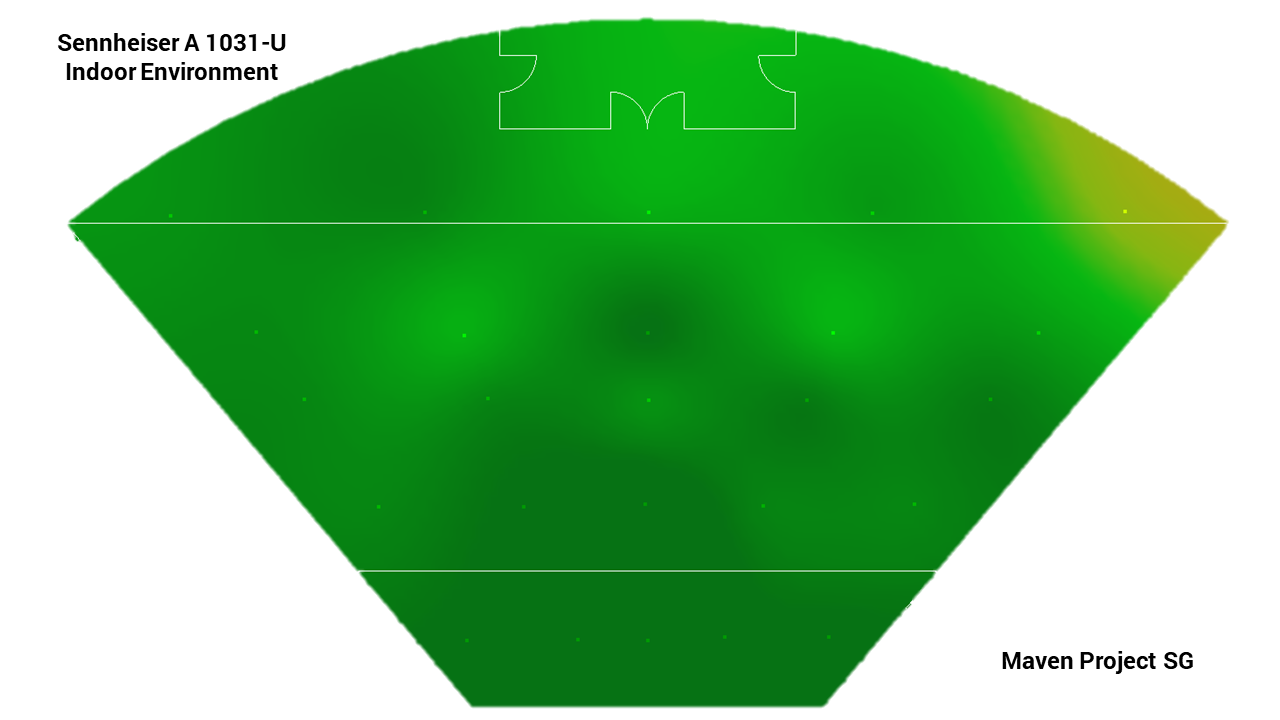

Antenna Shootout Professional Audio Part 1 Omnidirectional Antenna Maven Project Sg

Sennheiser A 1031 U Passive Receiving Transmitting Antenna Idjnow

아세아음향

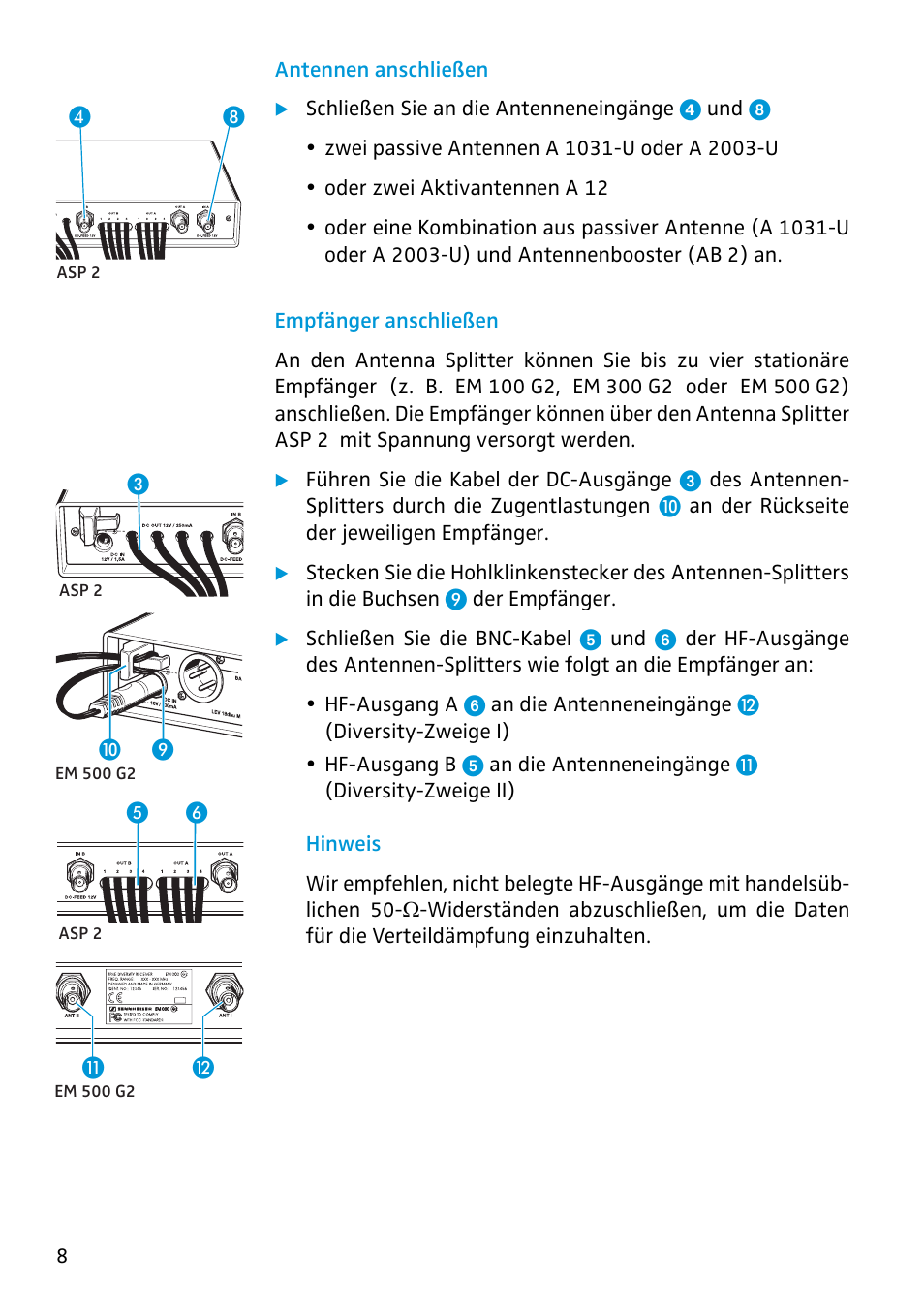

Antennen Anschliessen Empfanger Anschliessen Sennheiser Antenna Splitter Asp 2 User Manual Page 6 49 Original Mode

Sennheiser A 1031 U Passivnaya Nenapravlennaya Antenna Dlya Radiomikrofona Arenda I Prokat V Moskve I Mo Na Party365

One Pair Sennheiser A 1031 U Antenna Aerial Wireless Microphone Iem Booster

1

Sennheiser A1031 U Passive Omnidirectional Antenna Sweetwater

Sennheiser A 1031 U Instructions For Use Manual Pdf Download Manualslib

Sennheiser A 1031 U Owner S Manual Immediate Download

Sennheiser A 1031 U Antena Dookolna Uhf Nadawczo Odbiorcza

West Auctions Auction Audio Visual Lighting Road Cases And Event Production Equipment Item Sennheiser A 1031 U Antennas

Sennheiser A 1031 U Support And Manuals

Uhf Antenna A 1031 U Sennheiser Kupit Po Luchshim Cenam V Kieve Uznat Stoimost Na Aksessuary Dlya Mikrofonov V Internet Magazine Luxpro

Antenna Dlya Radiosistemy Sennheiser A 1031 U Kupit Aksessuar Dlya Radiosistem Sennheiser A 1031 U

Sennheiser Em 1031 U True Diversity Wireless Microphone Receiver Pair 674 698mhz Av Gear

2

Sennheiser A 1031 U Wideband Passive Omni Directional Uhf Antenna

Sennheiser A 1031 U Passive Omni Directional Antenna

Sennheiser A1031 U Passive Omnidirectional Antenna Sweetwater

Sennheiser Skm1072 U Service Manual Immediate Download

Amazon Com Sennheiser A1031 U Wideband Passive Omnidirectional Uhf Antenna For Evolution Series Electronics

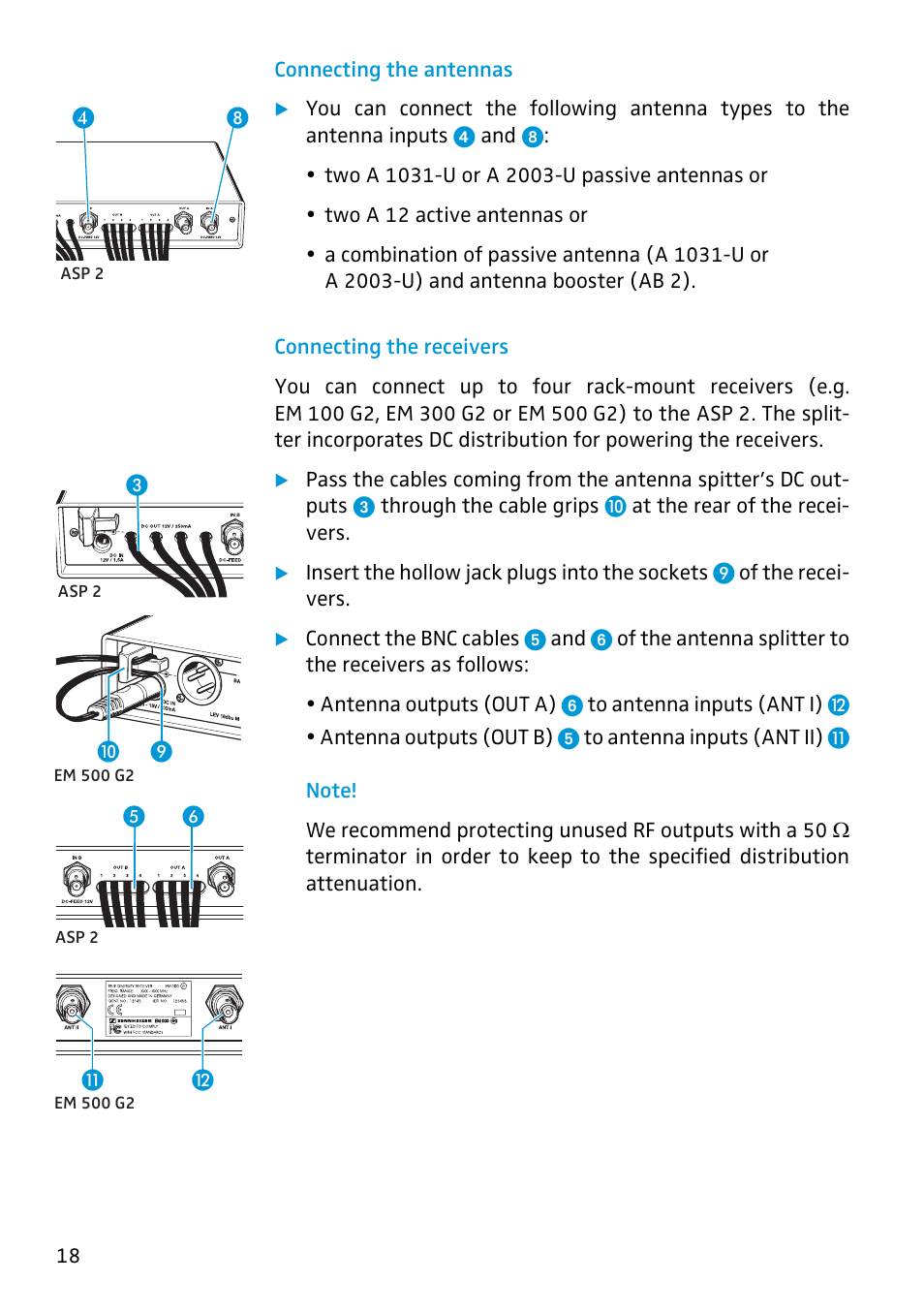

Connecting The Antennas Connecting The Receivers Sennheiser Antenna Splitter Asp 2 User Manual Page 18 49

A 1031u Sennheiser A 1031u Audiofanzine

Sennheiser A 1031 U Antenne Passive Omnidirectionnelle

Passivnaya Nenapravlennaya Uhf Antenna 450 960 Mgc Snk S Distribyutor Proav

Sennheiser Em 1031 U Bf 1081 U Frank Raumt Auf Reverb

Sennheiser A 1031 U Passive Omni Directional Antenna

Sennheiser A 1031 U Passive Omni Directional Antenna Canada S Favourite Music Store Acclaim Sound And Lighting

Sennheiser Em 1031 U True Diversity Receiver Wireless Microphone System 59 95 Picclick

Sennheiser A 1031 U Passive Omni Directional Antenna

Sennheiser A 1031 U Accessories Microphones Wireless Audio Rent

Sennheiser Pas A 1031 U Receiving Transmitting Antenna Passive Omnidirectional Bnc Connector

Antenna Sennheiser A 1031 U

Sennheiser A1031u Remote Omnidirectional Antenna Hand Held Audio

Ablegrid Ac Dc Adapter Fits Sennheiser Ng 1031 1 Art Nr For Bfr 1051 Em 1031 U True Diversity Uhf Wireless Mic Receiver Class 2 Transformer World Wide Use Power Supply Cord Walmart Com Walmart Com

Sennheiser A 1031 U Passive Omni Directional Antenna

Sennheiser A 1031 U Omni Directional Antenna Pair 255 00 Picclick Uk

West Auctions Auction Surplus Auction Of Vehicles Sound Lighting And Production Equipment Item 2 Sennheiser A 1031 U Passive Omni Directional Antenna

Antenna Shootout Professional Audio Part 1 Omnidirectional Antenna Maven Project Sg

Ac3kwd Antenna Combiner User Manual Sennheiser Active Antenna Splitter 2 X 1 8 Sennheiser Electronic Ny

Page 5 Of Sennheiser Stereo Receiver Em 1031 U User Guide Manualsonline Com

Sennheiser A 1031 U Wainwright Musical Reverb

Sennheiser A 1031 U Passivnaya Vsenapravlennaya Antenna Dlya Radiosistem

Sennheiser A 1031 U Passive Omni Directional Antenna

Antenna Shootout Professional Audio Part 1 Omnidirectional Antenna Maven Project Sg

2

Sennheiser A 1031 U 3d Warehouse

Sennheiser Rf Paddle A A 1031 U Omni Directional Dpl

Sennheiser Adp Uhf Radiomic Antenna Directional Passive Bnc 470 1075mhz

West Auctions Auction Audio Visual Lighting Road Cases And Event Production Equipment Item Sennheiser A 1031 U Kit With Case

1

Sennheiser A 1031 U Amazon Co Uk Electronics Photo

0 件のコメント:

コメントを投稿